Cryptocurrency settlements exceeded $175 million in the past hours

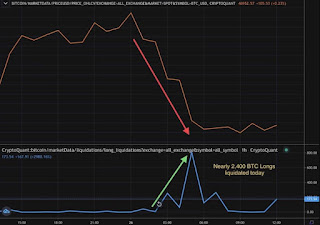

Officially, Bitcoin has entered a bear market. Proof of this is the massive liquidations of cryptocurrencies that have continued over the past three days. In the last 24 hours and according to data from the Coinglass analysis platform. There have been more than $900 million in liquidations from the cryptocurrency market. About 80% of the liquidations were due to the elimination of traders in long positions.

Bitcoin liquidations have reached nearly $500 million since Wednesday. The bitcoin sell-off was a result of the bitcoin price dropping from $46,000 to below $41,500, and the bitcoin price is currently around $42,300, down nearly 2% on the day.

Bitcoin market sentiment is now divided between bulls and bears

After the bitcoin price crash and heavy selling, market sentiment is polarized. Some market experts have stated that Bitcoin is now officially in a bear market. For example, KSICRYPTO, previously called the bearish trap, has been corrected and now says it is clearly a bear market.

A Bitcoin investor and CryptoWhale skeptic, who has long been anticipating a bear market for Bitcoin in 2022, confirmed that he was not surprised by the price drop. He argues that Bitcoin has long been in a bubble backed by fake money and fraud. He points out that Tether, the issuer of the USDT stablecoin, is behind the scam. He also adds that the demand for Bitcoin is so low that the only people who are buying are the retail investors who didn't know the bubble better.

Moreover, cryptocurrency exchanges are expected to take action and stop operating in an attempt to reduce trading and prevent the price of Bitcoin from dropping further. Although, according to him, this bitcoin bear market will drag the price of BTC below $10,000.

Metrics Still Show Hope for Bitcoin (BTC) Bulls

On the contrary, some market analysts remain bullish on Bitcoin. According to “Smartcontracter”, the price of Bitcoin is likely to drop to a low of around $37,500 and give a similar structure to the market in 2019. The analyst still expects Bitcoin to reach $100,000 this year.

This shot is similar to that of the Glassnode analytics platform. In a recent report, Glassnode explained that Bitcoin is not currently in a bull market given the sluggish activity on the chain. However, Glassnode hopes that if the number of new entities entering the market continues to increase (as it has now), Bitcoin can gain momentum to enter a bull market again, just as it did in 2019. When this happens, it will also expect to rebound. Bitcoin price.

Disclaimer: The content and links in this article are for informational purposes only. Zaoui does not provide legal, financial or investment recommendations or advice, nor is it a substitute for due diligence for each interested party. zaoui does not endorse any investment or similar offers promoted here.